WELCOME TO

Drink Tea & Travel

An Award-Winning Sustainable Travel Blog with a mission to inspire an unconventional lifestyle and sustainable travel practices in around the world.

We are Oksana & Max,

an ordinary couple living an extraordinary lifestyle!

We like to drink tea and travel and use this site to share our travel guides, itineraries and travel tips to help you plan your next adventure!

Since 2015, we’ve been traveling full-time, visiting all 7 continents and over 90 countries on countless adventures in all corners of the world!

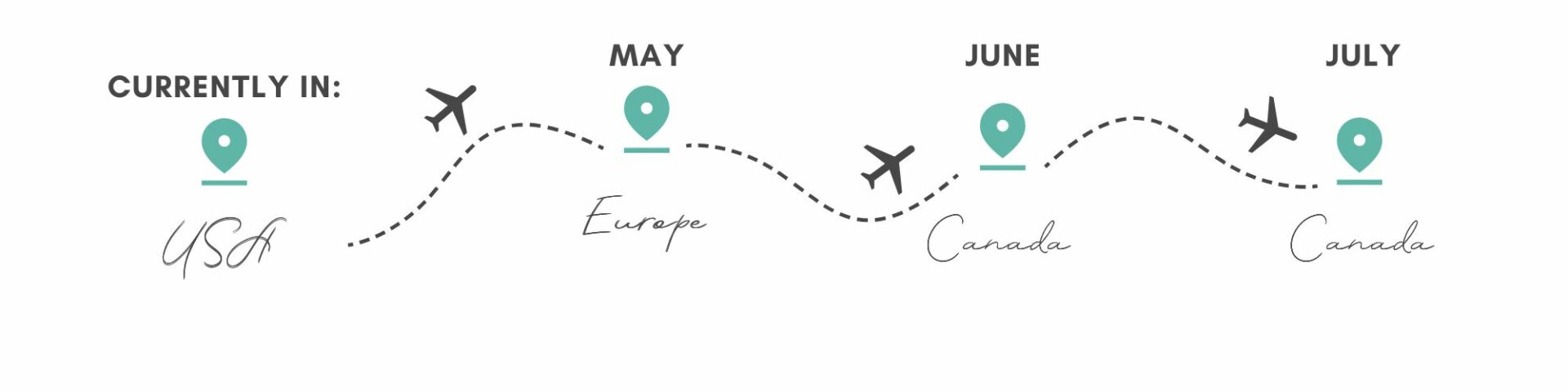

Upcoming Travel Plans

Latest Travel Videos

Sustainable Travel

As avid sustainable travel advocates, we have put together a number of articles with useful tips and advice on exploring more mindfully and responsibly.

Latest Articles

Featured Destinations

Canada

Our home, Canada, has been our playground for many years and we’ve been lucky enough to explore many corners of this beautiful destination.

In 2020-2022, we road-tripped across Canada in our self converted Sprinter Campervan, Benji, exploring many top destinations as well as some off-the-beaten-track regions.

But the adventures didn’t end there…

Costa Rica

Over the years, Costa Rica has become our home away from home. We visit Costa Rica multiple times a year to see family, to relax on the beaches on Guanacaste, and explore new destinations around the country.

We’ve compiled a large collection of tips and advice for visiting this beautiful country’s top destinations and lesser-known spots.

Australia

From 2009 until 2015, Australia was our home. We lived in Brisbane and traveled extensively throughout Australia.

Over the years, we’ve visited every state in Australia, done many epic road trips (including an 18,000 km half-lap) and ticked off a lot of iconic Australian experiences.

Our adventures continue… We come back to Australia often to visit new destinations on a mission to see every corner of this beautiful country (we’re getting close).

South Africa

Having visited South Africa 4 times, we are now convinced – it’s one of the most beautiful and diverse destinations in the world.

From stunning Cape Town, to the charming wine lands of Stellenbosch and Franschhoek, to adventures along the Garden Route, off the beaten path National Parks, and of course the wildlife mecca of Kruger – this country has something for everyone!

Stay in Touch

Sign up today and get an inside scoop on our unconventional life!

PLUS regular updates with new posts and behind-the-scenes stories!

Subscribe to our Newsletter